India is currently among the most watched Emerging Market nations. To top that, the Indian Equity Markets have witnessed unprecedented growth in the recent months. The YTD returns for Sensex alone has been 26% (data from BSE India). The euphoria and high confidence on the Indian Equities has continued to remain, especially from the institutional investors both foreign and domestic.

This is also leading to make many individual investors question whether they should invest in equities or sit on the sidelines. While individual risk appetite and time horizon would be some of the basic factors to understand before investing, there are many other fundamental factors to track. While the debate has been raging on as to which indicators should be looked at or ignored to make sense of the valuations of the Indian equity markets, the following factors can help bring some sense of clarity to the overall picture. Factors such as:

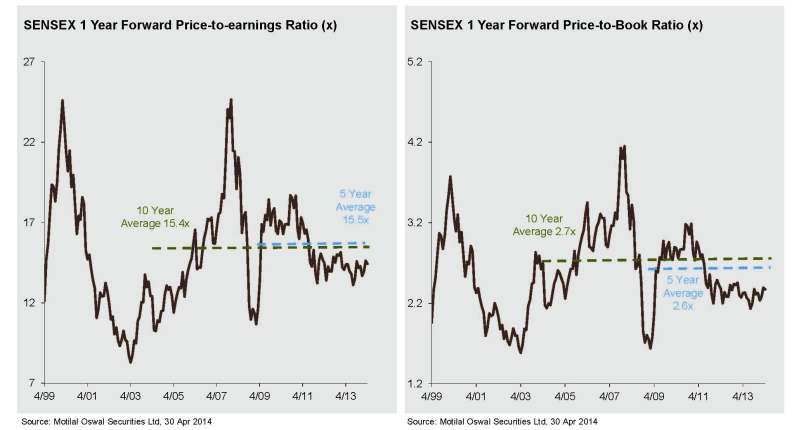

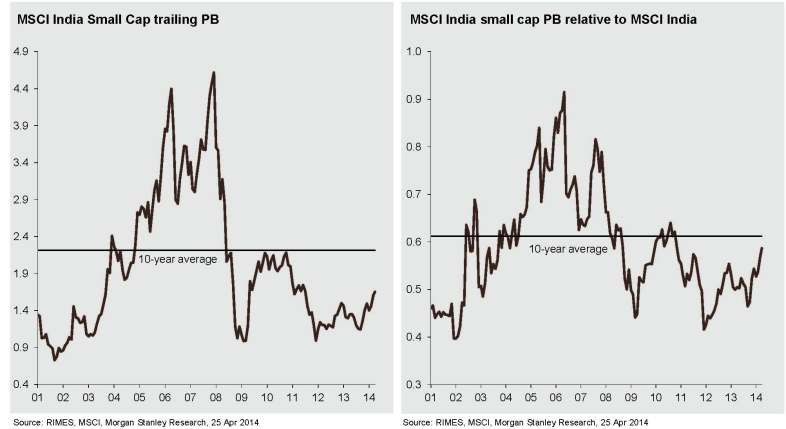

Current Price to Earnings Ratio (P/E Numbers): One of the most traditional tools used globally at gauging the valuations of an equity market of a country. In the last one year alone (based on data from Oct 16 to Oct 17), the P/E Ratio for S&P BSE Sensex has averaged close to 22 times in comparison to its historical average of approximately 17 on a trailing basis. For the BSE Mid Cap and Small Cap of the same period, the P/E valuations are at an average of 33.8 and 81.13 times.

Corporate Earnings: P/E Ratios are directly linked to the corporate earnings of the country. As per Kotak Institutional Equities Estimates, the Expected Earnings for companies representing the Nifty 50 Index are approximately 2% in FY 2018. A variety of reasons are attributed to these low earnings expectations, most famously discussed are the implementations and effects of Demonetization and Goods and Service Tax (GST).

Crude Oil Prices: Nearly 80% of India’s energy needs are import dependent. A direct consequence of this is the risk to the country’s inflation rate if the prices of crude oil are to rise. A rise in oil prices results in lower cashflows/profits for companies and higher prices for consumers. Brent crude oil prices are currently firming up at prices upwards of 60$ per barrel. This is a definite concern from an Indian economy perspective.

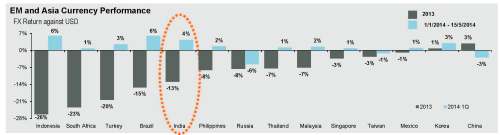

Exchange Rates: The Rupee is currently considered overvalued basis its 10 year average (Source: Kotak Research). This has a dual impact on the economy i.e. (A) it increases attractiveness of imported products, resulting in increased competition for domestic companies and lower profits; (B) it decreases the value of exported products and therefore hurts the margins of export based industries such as the IT sector. Both have resulted in muted growth prospects for these respective industries.

Bond Yields: In an growing economy like India, both equities and bonds compete for capital. In a equity bull rally, money is taken out from bond markets and pumped into equities, forgoing risk to capital for riskier investments. Currently bond yields are inching up to the mid 2017 high of 6.987% yield for the 10yr G-Sec. However there has only been net inflows into fixed income. Foreign Portfolio Investments into Government Securities have already reached 83.94% of their allotted limit (data dated as per 6th Nov NSDL)

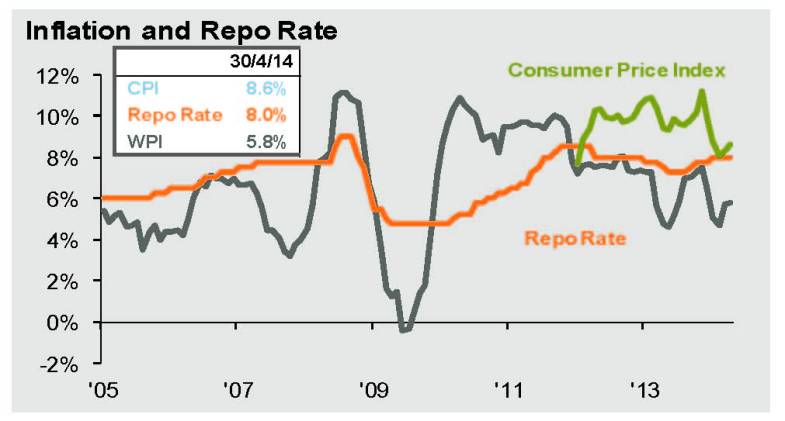

Inflation Rate: Inflation brings about it own risks to the stock markets. In the last Monetary Policy Committee meeting, the RBI revised the inflation projections for the rest of FY 2018 upwards to 4% – 4.5%. This may indicate a stop to future rate cuts, freezing any possibilities of reduction in lending rates. Medium term consequences for companies could possibly mean dearer than expected debt to service, resulting in subdued profits and revenue.

Role of FIIs: The way that Foreign Institutional Investors park monies in the market can give an indication to the current picture of that market. While FIIs were very bullish on Indian Equities for most part of the calendar year, starting June they slowly but surely tapered inflows in equity, finally resulting in net outflows in the month of September and October. (Source: moneycontrol)

Global Scenario: On a global scale, economies are starting to look up, with further growth expected. According to IMF Economic Outlook, average expected GDP growth for FY 2017 is 2.5%. Globally, equity markets have participated in this growth including India. What probably may need to be put in perspective is that the rally in Indian Equities may be partly due to the global rallies taking place. Therefore the Indian equities are associated with risks in terms of foreign external factors like outbreak of war in the Korean Peninsula. Such events are likely to have negative impacts on the domestic markets.

Keeping in mind the above mentioned factors, Plan Ahead Wealth Advisors has a definite view that current equity markets are over valued and investors should exercise caution. The not so positive indicators from these mentioned factors should mean a significant correction cannot be discounted, keeping us wary of diving too much into equities without first educating investors of the potential risks in the short to medium term horizon.